The Ultimate Guide to Understanding Your Rights as a Medicare Recipient

Understanding your rights and the regulations that protect you as a Medicare recipient is vital in navigating the complex world of healthcare coverage.

Unveiling the Truth: Why Original Medicare Isn’t Enough

While Original Medicare serves as a fundamental safety net, it’s evident that it doesn’t provide comprehensive coverage. To ensure that your health needs are fully met, consider supplementing with Part D, Medigap, or a Medicare Advantage plan.

Navigating Medicare Penalties: Your Guide to Staying Informed and Penalty-Free

Your financial well-being is our top priority at Vista Mutual Insurance Services. Understanding and avoiding Medicare penalties is a vital part of maintaining your financial health.

How to Compare Private Insurance Companies With Medicare

With so many options available, each offering different plans and benefits, it’s essential to know how to compare them effectively. This guide will provide you with the necessary information to make an informed decision when selecting a private insurance company for your Medicare coverage.

Make the Most of Your Medicare Preventive Care and Screenings

Medicare offers a variety of essential preventive services at no cost to help keep you healthy, detect conditions early, and prevent severe illnesses. As a Medicare insurance agency, we encourage our clients to use these valuable free preventive benefits available through Original Medicare and Medicare Advantage plans.

Medicare Supplement Plans: Exploring Popular Options and How They Can Benefit You

Medigap policies are private health insurance plans designed to supplement Original Medicare (Part A and Part B). They help cover out-of-pocket costs like deductibles, copayments, and coinsurance that Original Medicare does not cover. Medigap policies can offer financial protection and peace of mind by reducing your overall healthcare expenses.

Medicare Supplement Plans: Exploring Popular Options and How They Can Benefit You

Medicare Supplement (Medigap) plans can be invaluable to your healthcare coverage, offering financial protection and peace of mind. By understanding the benefits, eligibility requirements, and factors to consider when selecting a plan, you can make an informed decision and find the Medigap policy that best meets your unique needs

How to Find a Primary Care Doctor Accepting New Patients Under Medicare

One of the easiest ways to begin your search for a primary care doctor is to research online. Medicare offers a database of physicians who accept Medicare payments. You can input your zip code and browse the list of doctors in your area.

Medigap Enrollment Periods

It’s important to understand when to enroll in a Medigap plan. There can be significant consequences for failing to enroll in a Medigap plan at the correct time. When you first become eligible for Medicare and during certain special circumstances, you can enroll in a Medigap plan without having to health qualify. If you apply for a Medigap plan outside those enrollment periods, you may be denied coverage or have to pay more for your plan.

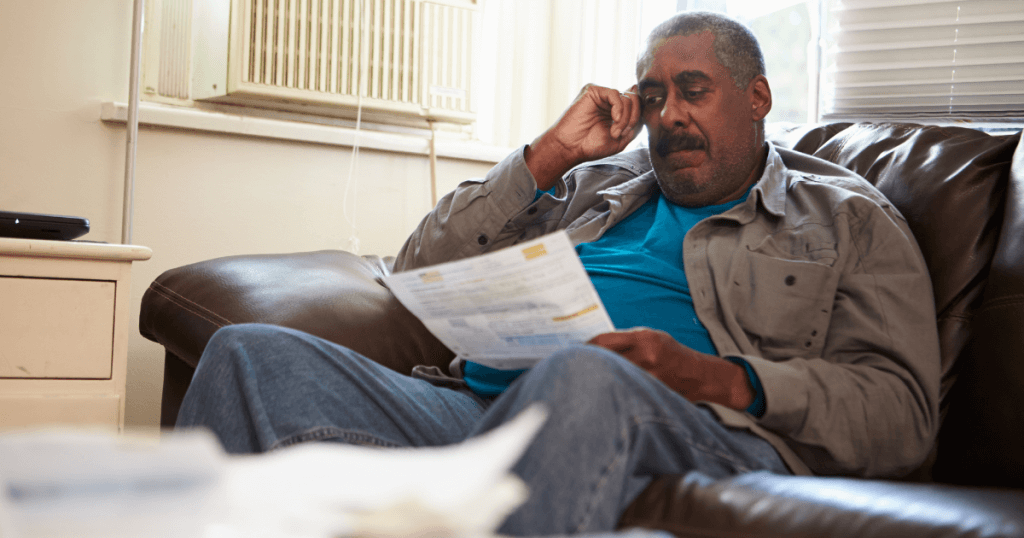

5 Surprising Things Medicare Doesn’t Cover

Many people assume that Medicare will pick up their healthcare costs when they retire. Unfortunately, this mistake can create big problems when a senior goes in for a procedure and ends up with an unexpected bill.

While Medicare has some pretty surprising gaps in coverage, private insurance plans can help cover those gaps. If you are interested in additional coverage to help with your Medicare, Medicare supplements and Medicare Advantage plans are good options.