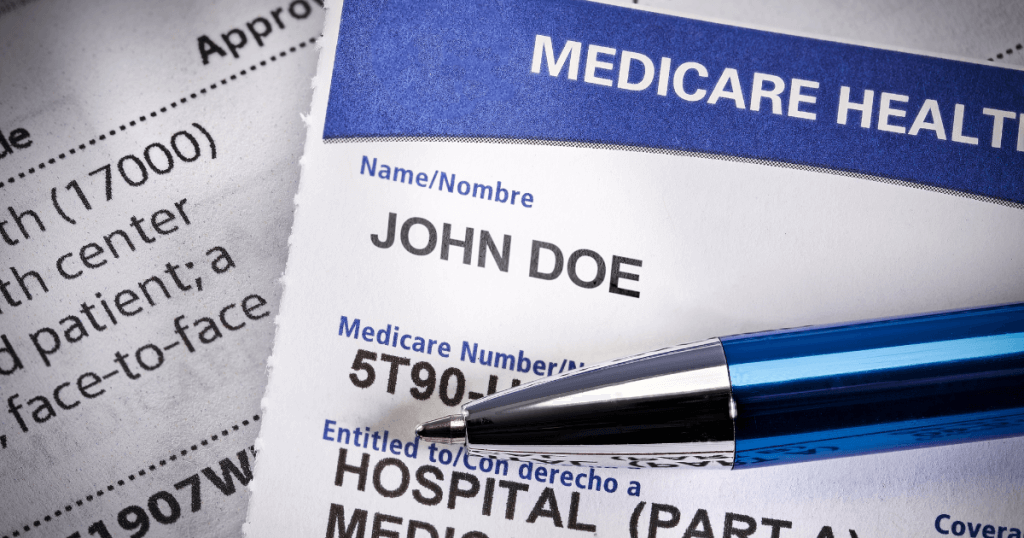

Unraveling the Changes to Medicare Part D in 2024 and 2025

With the recent passage of the Inflation Reduction Act of 2022, the Medicare landscape is poised for several significant changes that will directly impact enrollees. This article aims to demystify these upcoming changes to Medicare Part D in 2024 and 2025, with a focus on how enrollees stand to benefit from these modifications.

The Ultimate Guide to Understanding Your Rights as a Medicare Recipient

Understanding your rights and the regulations that protect you as a Medicare recipient is vital in navigating the complex world of healthcare coverage.

Unveiling the Truth: Why Original Medicare Isn’t Enough

While Original Medicare serves as a fundamental safety net, it’s evident that it doesn’t provide comprehensive coverage. To ensure that your health needs are fully met, consider supplementing with Part D, Medigap, or a Medicare Advantage plan.

Navigating Medicare Penalties: Your Guide to Staying Informed and Penalty-Free

Your financial well-being is our top priority at Vista Mutual Insurance Services. Understanding and avoiding Medicare penalties is a vital part of maintaining your financial health.

Medicare Basics

Understanding Medicare’s various components and enrollment processes is the first step towards securing your health coverage. While the process might seem overwhelming, taking it step by step and understanding your options can make it manageable. Always remember to apply promptly to avoid penalties, and don’t hesitate to reach out to Social Security for any assistance you may need during your enrollment process. After all, your health is an investment that always pays off.

Make the Most of Your Medicare Preventive Care and Screenings

Medicare offers a variety of essential preventive services at no cost to help keep you healthy, detect conditions early, and prevent severe illnesses. As a Medicare insurance agency, we encourage our clients to use these valuable free preventive benefits available through Original Medicare and Medicare Advantage plans.

How to Find a Primary Care Doctor Accepting New Patients Under Medicare

One of the easiest ways to begin your search for a primary care doctor is to research online. Medicare offers a database of physicians who accept Medicare payments. You can input your zip code and browse the list of doctors in your area.

Medicare Rates for 2023

Each year the Centers for Medicare and Medicaid Services (CMS) releases updated rates for Original Medicare (Part A and Part B).

The Part B premium will be lower for 2023, the first time in over a decade that rates fell rather than increased.

Costly Medicare Mistakes to Avoid Part 1

Healthcare costs consistently rank among the highest household expenses. However, choosing a health plan is often complicated and confusing.

This series will look at costly mistakes to avoid when you are new to Medicare.

5 Surprising Things Medicare Doesn’t Cover

Many people assume that Medicare will pick up their healthcare costs when they retire. Unfortunately, this mistake can create big problems when a senior goes in for a procedure and ends up with an unexpected bill.

While Medicare has some pretty surprising gaps in coverage, private insurance plans can help cover those gaps. If you are interested in additional coverage to help with your Medicare, Medicare supplements and Medicare Advantage plans are good options.